As businesses grow more digital, many are turning to aggregation models to deliver content, services, or transactions across multiple providers in one seamless environment. The casino game aggregator model is one striking example, connecting hundreds of vendors, payment processors, and compliance tools into a single interface. But with convenience and scale comes complexity — and risk.

When a platform integrates dozens or even hundreds of third-party systems, each connection becomes a potential entry point for security threats. Data privacy laws like GDPR in Europe or CCPA in California impose heavy penalties for breaches, while payment providers demand strict anti-fraud measures before approving integrations. In a world where one weak link can compromise an entire network, aggregated platforms face unique challenges in keeping systems secure without slowing innovation.

The New Security Perimeter

Traditional IT security focused on building walls around company data. But aggregated platforms extend far beyond a single data center. APIs connect multiple external partners, cloud services handle payments, and users access platforms from anywhere in the world. The old “castle and moat” model no longer works; security now has to travel with the data itself.

This shift requires a zero-trust approach: no user, device, or API call is automatically trusted, even inside the platform’s own ecosystem. Identity verification, real-time monitoring, and encryption become non-negotiable. For a casino game aggregator, for instance, that might mean verifying the integrity of game data, protecting player identities, and encrypting every transaction across borders — all in milliseconds.

Managing Third-Party Risk

Aggregated platforms rely on external vendors for everything from content to payments. Each partner relationship expands the attack surface. Security teams now perform continuous due diligence, monitoring vendor compliance certifications, penetration test results, and incident reports.

Automated risk scoring systems help by flagging anomalies early. If a single data feed starts behaving suspiciously — say, delivering unexpected traffic volumes — the platform can isolate it instantly before wider damage occurs. Aggregation doesn’t eliminate risk, but it demands smarter, faster risk management at every layer.

Compliance as a Competitive Edge

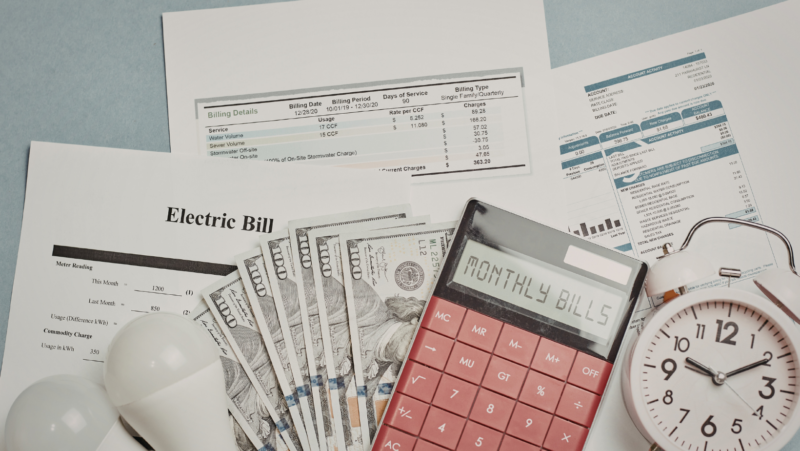

Far from being just a legal obligation, compliance is now a selling point. Players, customers, and payment providers prefer platforms that can prove they meet the strictest standards for fairness, privacy, and financial security. Certifications like ISO 27001 or PCI DSS signal that an aggregated platform takes data protection seriously.

For operators, embedding compliance tools directly into platform architecture reduces costs over time. Instead of scrambling for audits before every license renewal or partner onboarding, the system generates real-time compliance reports automatically.

The Role of AI and Automation

Artificial intelligence is emerging as a critical ally in securing aggregated ecosystems. Machine learning models detect fraud patterns invisible to human analysts, while automated incident response systems can shut down suspicious activity in seconds rather than hours.

At scale, this speed is essential. A casino game aggregator processing thousands of bets per second or a fintech platform handling millions of micro-transactions daily can’t rely on manual oversight alone. Automation ensures threats are addressed before they disrupt operations or erode user trust.