Horse racing is popular worldwide. However, countries like the US and Australia share a deep connection with it. This connection stems from history and culture. Still, both countries approach the sport differently. The betting markets, regulations, and wagering behaviors show the contrast between the two. This difference is emphasized in how each industry is embracing modernization and digitalization. In this article, we’ll explore the horse racing landscapes of the US and Australia, and see where they differ and connect.

How Big Are The Horse Racing Betting Markets?

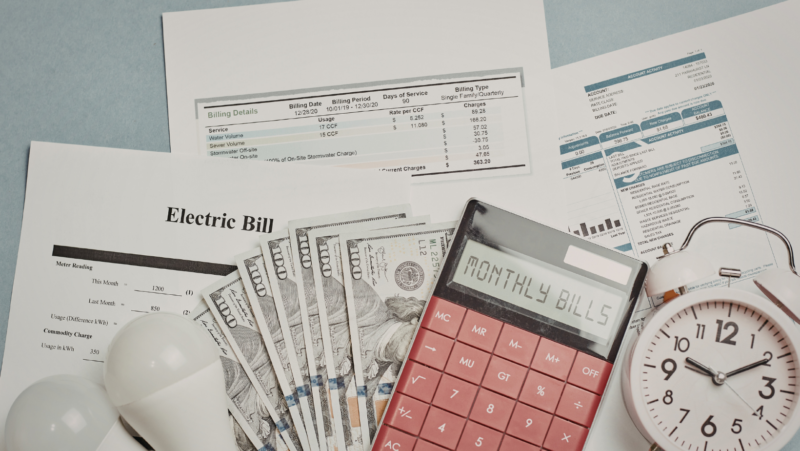

The United States horse racing betting market stood at $11.2 billion in 2024, with a 3.35% drop from 2023’s $11.6 billion. Contributing to this slight decline was the 5.01% drop in betting during the fourth quarter. This can be attributed to reductions in pari-mutuel betting and growing competition among sportsbooks. Moreover, many bettors’ attention had been divided among US leagues, where football, basketball, and baseball drive steady handle. Horse racing, however, still holds a recognized place within the broader market.

Fans looking for a dedicated view of race cards, prices, and bet types visit sites like https://racing.fanduel.com. The availability of these resources shows that race wagering remains accessible to bettors who prefer traditional formats, even amid the fast-moving sports calendar. Many experts also believe that betting will revive interest once more, with substantial enthusiasts thinking that the sport is due for another surge.

Meanwhile, Australia’s thoroughbred racing had increased from $9.6 billion in 2001 to a record of $29.1 billion in 2021. This means that it has gone from 7.4% to over 25%. A study conducted on the wagering boom after the pandemic found that 38.1% of Australians bet on horse racing.

Moreover, unlike US revenue, its nationwide participation and centralized betting systems are spread across smaller tracks across the country. In Australia, horse racing is one of the few sporting events that generate mass appeal.

Wagering Behavior and the Digitalization of Betting

With Australia’s Northern Territory regulating the rapid expansion of online wagering platforms, the market has undergone a complete transformation. Because of the easy access to betting apps, more than half of the wagering is done online. Platforms offering real-time odds, microbetting, and enticing promotions now dominate the horse racing industry. With the continued shift to tech-based betting, new regulations have emerged for consumer protection and responsible gambling.

In the US, wagering is regulated under the Interstate Horse Racing Act (IHA), which means that wagering is only legal if all relevant racing authorities consent to it, namely:

- The host racing association,

- The horse racing commission,

- The off-track racing commission.

Only a few platforms are allowed to operate on a national level. And despite its steady growth, it represents a smaller share of the total handle compared to Australia. That is because fragmentation and varying betting regulations state-by-state prevent a complete digitalization of the horse racing betting industry. But with the expansion of sports betting legalization across the country, online horse racing is sure to follow.

Payments, Self-Exclusion, and Compliance

Australia tightened payments in 2024 by banning credit cards and credit-linked wallets for online wagering, bringing it into line with land-based rules. National self-exclusion via BetStop has scaled and cleared 44,841 registrations by June 30, 2025, with 30,032 active exclusions. These are hard compliance levers that shape operator UX and player flows every day.

The US framework differs because each state sets its own responsible gambling and data controls. A cross-state review catalogues varying standards on marketing, data privacy, account tools, and source-of-funds checks, which means product and compliance costs change at the state line. That patchwork matters when reading hold rates, promo intensity, and market entry strategies across the map.

Following the Money From Handle to Treasury

In the US, betting companies pay taxes to each state. That steady tax money helps states support and grow legal betting. It also explains why new states keep opening for business even when companies cut back on special offers.

Australia tracks its betting money in a different way, but the idea is similar. The same reports that show how much people bet also show how much money goes to the government and to racing groups. When rules change, the effects show up fast.

For example, the 2024 rule that banned credit cards for online betting made companies adjust how they work and pay. Those changes flow through to how state racing and local community programmes get funded.

The Changing Horse Racing Landscape

The horse racing scene in the US and Australia shows how the sport can grow in different ways. Australia’s robust and centralized regulations differ entirely from the US’s complex regulatory environment. Moreover, the new wagering behavior brought by digitalization has changed how these countries uniquely addressed demand for online participation. But despite these differences, horse racing remains an essential part of each nation’s economy and culture.