All of These are Settlement Options for Life Insurance Except

When it comes to life insurance, there are various settlement options available to policyholders. These options determine how the benefits of the policy will be paid out to the beneficiaries. As an expert in the field, I have explored and analyzed the different settlement options that individuals can choose from. In this article, I will delve into three popular choices that provide financial security and flexibility for policyholders and their loved ones.

One settlement option for life insurance is a lump sum payment. This means that the entire benefit amount is paid out to the beneficiaries in one go. This option can provide immediate financial support to the loved ones left behind, allowing them to cover expenses such as funeral costs, outstanding debts, or other financial obligations. I’ll discuss the advantages and considerations of choosing a lump sum payment as a settlement option, and how it can provide peace of mind during difficult times.

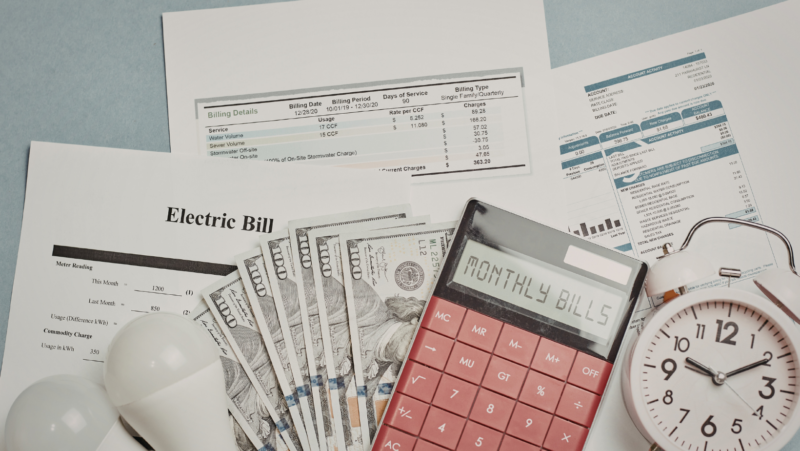

Another settlement option to consider is the installment payment. With this option, the life insurance benefit is paid out in regular installments over a specified period of time. This can be particularly beneficial for beneficiaries who may not have experience managing a large sum of money all at once. I’ll explore the advantages of installment payments, including how they can provide a steady income stream and ensure long-term financial stability for beneficiaries.

Lastly, there is the option of a life income settlement. This option provides a guaranteed income for the beneficiaries for the rest of their lives. It offers a level of financial security and eliminates the risk of mismanaging a lump sum payment. I’ll delve into the details of a life income settlement, including how it works, its potential tax implications, and the factors to consider when choosing this settlement option.

Understanding Life Insurance Settlement Options

When it comes to life insurance policies, there are several settlement options available for beneficiaries. In this section, I will explain three popular settlement options: lump sum payment, installment payment, and life income settlement. Each option has its advantages and considerations, empowering you to make an informed decision about your policy.

Lump Sum Payment

One of the most common settlement options is the lump sum payment. In this option, the beneficiaries receive a one-time payment of the full policy amount after the insured person’s death. This immediate financial support can be beneficial in covering funeral expenses, paying off debts, or investing the funds for the future. However, it’s important to consider potential tax implications and the possibility of misusing the lump sum of money.

Installment Payment

Another settlement option to consider is the installment payment. Instead of receiving a lump sum, beneficiaries receive regular installments over a specified period of time. This option provides a steady stream of income, which can be particularly useful for beneficiaries who may not have experience managing large sums of money. Additionally, installment payments spread out over a longer period of time can help to mitigate tax liabilities. However, it’s important to be aware that the total amount received may be lower than the lump sum payment due to interest and inflationary factors.

Life Income Settlement

The third settlement option is the life income settlement. With this option, beneficiaries receive a lifelong income stream, sometimes referred to as an annuity. This guarantees a steady income for the rest of the beneficiary’s life, providing security and stability. Additionally, the life income settlement can be structured to include cost-of-living adjustments, protecting against inflation. However, it’s important to note that the amount received may be lower compared to other settlement options, as the payments continue for the lifetime of the beneficiary.

Understanding the various settlement options for life insurance policies is crucial in making the right decision for your specific needs. Whether you opt for a lump sum payment, installment payment, or life income settlement, it’s important to weigh the advantages and considerations of each option, considering your financial goals and circumstances. By making an informed decision, you can ensure that your life insurance proceeds provide the necessary financial support for your loved ones.