Recognizing revenue on account is a crucial aspect of financial management that can have a significant impact on a company’s financial statements. In this article, I’ll delve into the intricacies of recognizing revenue on account and how it affects the overall financial health of a business. We’ll explore the key principles and guidelines that govern revenue recognition, as well as the potential implications for a company’s financial statements. Whether you’re a business owner, an accountant, or simply interested in understanding the complexities of financial reporting, this article will provide you with valuable insights into the world of recognizing revenue on account.

Recognizing Revenue on Account Affects Financial Statements By Increasing ______.

I’d like to delve deeper into the impact of recognizing revenue on account on a company’s financial statements. This key aspect of financial reporting plays a crucial role in presenting an accurate picture of a company’s financial health. Let’s explore how revenue recognition affects the financial statements and what it means for a business.

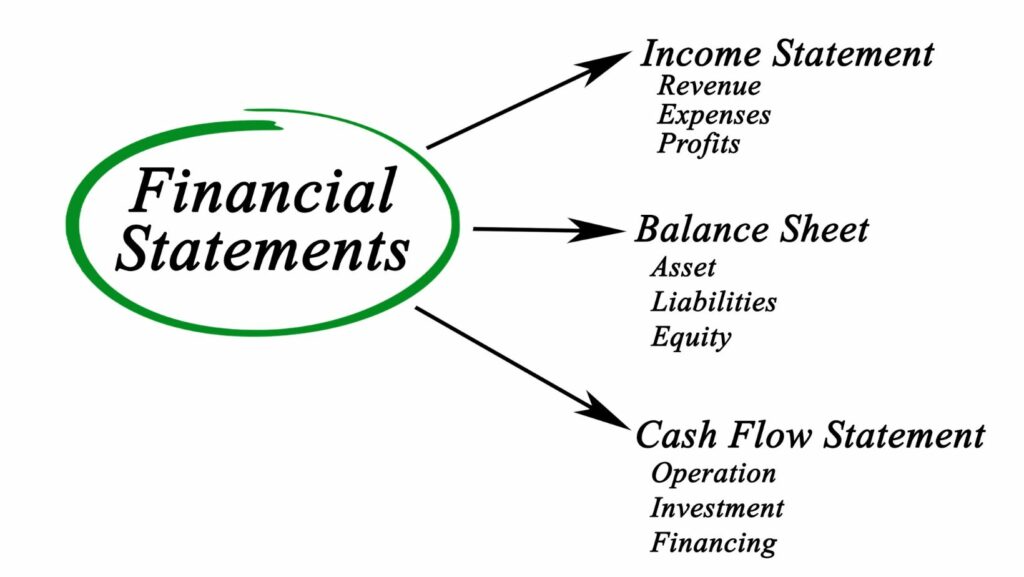

Income Statement

Recognizing revenue on account directly affects a company’s income statement. The income statement summarizes a company’s revenues, expenses, and net income over a specific period. By recognizing revenue on account, a company records revenue when it is earned, regardless of when the payment is received. This ensures that the income statement reflects the actual performance and profitability of the business.

Balance Sheet

The impact of recognizing revenue on account is also evident on a company’s balance sheet. The balance sheet provides a snapshot of a company’s financial position at a given point in time. When revenue is recognized on account, it increases both accounts receivable and retained earnings on the balance sheet.

Accounts receivable represents the amount of revenue that has been earned but not yet received from customers. It is shown as an asset on the balance sheet. The increase in accounts receivable reflects the amount owed to the company by customers for products or services delivered.

Cash Flow Statement

The cash flow statement highlights the cash inflows and outflows of a company during a specific period. Recognizing revenue on account affects the cash flow statement indirectly. Although revenue may be recognized on account, the actual cash receipt may happen at a later date. This leads to a difference between the revenue recognized on the income statement and the cash received, affecting the operating cash flow section of the cash flow statement.

It is important for analysts and investors to examine both the income statement and the cash flow statement to gain a comprehensive understanding of a company’s financial performance and its ability to generate cash.

The Importance of Accurately Recognizing Revenue on Account

Understanding the Impact on the Income Statement

When it comes to recognizing revenue on account, it’s crucial to understand the impact it has on a company’s financial statements. Let’s start by examining the effects on the income statement.

Accurately recognizing revenue on account allows a company to reflect its true performance during a specific period. It provides a clear picture of the revenue generated, expenses incurred, and ultimately the profitability of the business. By recognizing revenue on account, companies can ensure that their income statement accurately portrays their financial performance.

Analyzing the Effects on the Balance Sheet

Recognizing revenue on account increases the accounts receivable on the balance sheet. Accounts receivable represents the amounts owed to the company by its customers for goods delivered or services rendered on credit. By accurately recording this revenue, companies are able to have an accurate representation of the money owed to them and the liquidity of their business.

Furthermore, recognizing revenue on account also impacts the retained earnings on the balance sheet. Retained earnings represent the accumulated profits of the company that have not been distributed to the shareholders. By recognizing revenue on account, the retained earnings increase, signaling the growth and financial health of the company.

Examining the Impact on the Cash Flow Statement

Recognizing revenue on account creates a difference between the revenue recognized and the cash received. This discrepancy arises because revenue recognition is based on the accrual accounting method, where revenue is recognized when it is earned, rather than when cash is received.

Conclusion

Recognizing revenue on account is a critical aspect of financial management for businesses. By implementing effective credit policies, companies can minimize the risk of bad debt and ensure timely collection of payments. Regularly monitoring the creditworthiness of customers and conducting analysis and audits help maintain accurate financial records.

Utilizing reliable accounting software streamlines the process of recording and tracking accounts receivable, making it easier to manage revenue recognition. With accurate financial statements, businesses can make informed decisions and present a true reflection of their financial performance.