Starting your financial journey can be exciting—but it can also feel like diving into the deep end without knowing how to swim. Whether you’re stepping into your first job or earning from a side hustle, understanding money basics is essential. Financial mistakes made early on can stick around for years, while good habits built now can lead to lifelong confidence and stability.

But let’s be honest: most schools don’t teach you how to budget, save, or even understand how debit or credit cards work. That’s where this article comes in. We’re going to walk through eight things every young earner needs to know—from using your first debit card wisely to building a credit score the smart way.

Start with a Simple Budget

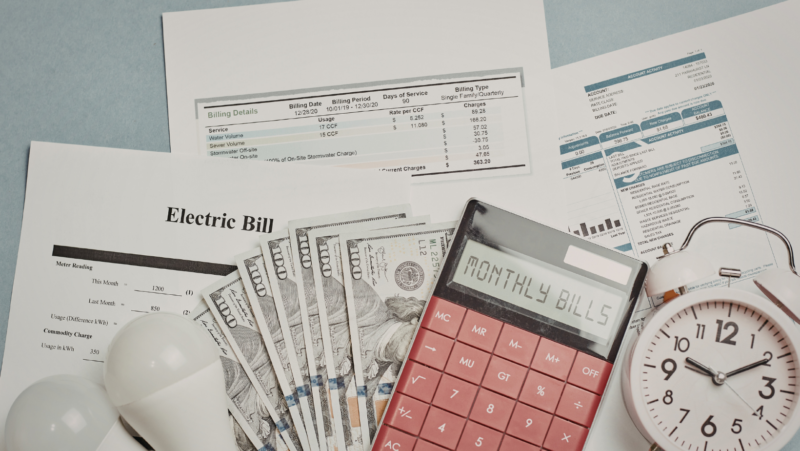

When your first paycheck lands in your account, the temptation to spend freely is real. But, do you know what’s the smartest thing you can do at that moment? It’s building a budget. A simple budget isn’t about limiting fun—it’s about knowing where your money goes and making sure you’re not caught off guard later. You don’t need to be a math whiz or download fancy software. A basic breakdown into three areas—essentials, savings, and personal spending—is enough to get started.

Your First Debit Card: What to Know and How to Use It

A debit card is one of the first tools you’ll use to manage money. It’s tied directly to your bank account, which means that every swipe, tap, or online purchase comes out of your actual balance. The good news is that getting one has never been easier. Many banks now allow you to apply for a debit card online, and you can often get it mailed to your address within a few days.

However, using a debit card comes with responsibility. It’s easy to forget how much you’ve spent when you’re not dealing with cash. That’s why it helps to check your balance regularly, either through your bank’s app or text alerts. Avoid overdrafts, which happen when you spend more than you have and can result in fees. Also, keep your card and PIN safe. Never share your card details over text or email, and if anything feels off, report it to your bank immediately.

Open a Checking and a Savings Account

Keeping all your money in one place isn’t ideal. A checking account is for your everyday spending, while a savings account is where you set money aside for future use. Having both makes it easier to see what’s meant for now and what’s meant for later. Many banks offer these two as a package, and online banks often have better interest rates and fewer fees than traditional ones.

One of the best habits to build early on is automating your savings. As soon as you get paid, set up a transfer—say 10%—to go straight into your savings account. That way, saving happens without you having to think about it every time. The goal is to make it part of your routine, just like paying a bill.

Understand Taxes and Your Pay Stub

The first time you look at your paycheck, you might wonder why the amount you received is smaller than expected. That’s because of taxes, and understanding them is important. Your pay stub will show several deductions, including federal and state income tax, Social Security, and Medicare. These aren’t random. They’re required by law and contribute to services and benefits you might use later in life.

Take the time to understand terms like “gross pay” (what you earn before taxes) and “net pay” (what you take home). Knowing what’s deducted helps you plan better. It also means you’ll be ready when it’s time to file your taxes each year, whether you do it yourself or get help from a service.

Track Your Spending (Without Making It Complicated)

It’s easy to lose track of small, frequent purchases—coffee, snacks, streaming subscriptions. But over a month, they can really add up. Tracking your spending doesn’t mean you have to stop enjoying things. It just helps you stay aware. Many banking apps now categorize your purchases automatically, showing you how much you spend on food, transport, or entertainment.

Review your spending every week or two. Look for areas where you’re consistently overspending or subscriptions you don’t use.

Start Saving for Emergencies (Yes, Really)

When you’re young and just starting to earn, emergencies might seem like something far off or unlikely. But you’re not immune to unexpected events, are you? Maybe your car needs a quick repair, or your laptop suddenly stops working. Without savings, even small problems can become stressful financial situations.

That’s why building an emergency fund is one of the smartest things you can do. You don’t need to save hundreds at once. Start with what you can—$20 or $30 a month makes a difference. Over time, that adds up. Keep this money in a separate savings account so you’re not tempted to dip into it for regular spending. The idea is to have quick access when you really need it without relying on loans or credit cards.

Avoid Debt Traps Early On

Credit cards, student loans, and buy-now-pay-later plans can seem like easy solutions. And sometimes they’re necessary. But it’s important to understand what you’re signing up for before you agree to borrow money. Many young earners fall into debt simply because they didn’t know how fast it can grow or what the repayment terms mean.

Only borrow when you truly need to, and always have a plan to pay it back. If you use a credit card, pay the balance in full each month to avoid interest charges. Never borrow just to keep up with friends or trends—it’s not worth it.

Set Short-Term Goals and Track Progress

Earning money without a goal can feel pointless after a while. Having short-term goals gives your savings a purpose and makes the process more rewarding. Maybe you want to buy a new phone, plan a weekend trip, or save for a course. Whatever the goal, break it down into a clear number and timeline. If your goal is to save $300 in three months, that’s $100 a month—or about $25 a week.

Keep track of your progress with an app, a notebook, or even a calendar. Seeing the numbers grow helps you stay motivated.

Building financial habits while you’re still early in your earning years puts you ahead of the game. A simple budget, smart use of a debit card, and understanding how your money flows in and out are small actions that lay the foundation for financial independence. You don’t need to get it perfect, and it’s okay to make mistakes—but the key is to keep learning and stay intentional. The better you understand your money now, the more freedom you’ll have in the future.