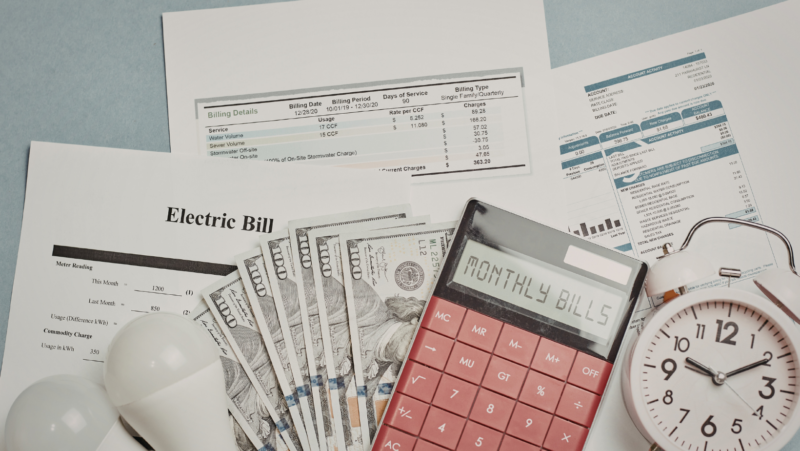

Material costs have always been the wild card in roofing projects. One week you’re quoting a job at $8,500, and by the time the homeowner signs, asphalt prices have jumped 12%. Your margin just evaporated, and you’re left explaining to your crew why their bonus check is smaller than expected.

Predictive analytics is changing this guessing game. Instead of reacting to price swings after they hit your distributor’s invoice, roofing companies can now anticipate fluctuations weeks or even months ahead. This isn’t about crystal balls—it’s about pattern recognition, historical data, and understanding the factors that actually move commodity prices in the building materials sector.

What’s Actually Driving Your Material Costs

Roofing supply chains don’t operate in a vacuum. Petroleum prices affect asphalt shingles. Tariffs on Chinese steel impact flashing and fasteners. Even hurricane season in the Gulf can create regional shortages that ripple across the country. Predictive models pull together these seemingly disconnected variables—crude oil futures, freight rates, manufacturing capacity reports, weather patterns—and identify correlations that human buyers simply can’t track manually.

The real value shows up when you’re bidding on projects with 60- or 90-day lead times. If the data suggests a 7% increase in shingle costs is likely within eight weeks, you can adjust your quotes accordingly or accelerate your material orders. Companies using modern CRM for roofing company operations are integrating these insights directly into their estimating workflows, so pricing decisions reflect tomorrow’s reality, not yesterday’s assumptions.

How Contractors Can Start Using Price Forecasting

You don’t need a data science team to benefit from predictive analytics. Several supply chain platforms now offer price forecasting tools specifically built for construction trades. These systems analyze purchasing patterns from thousands of contractors, cross-reference them with commodity indices, and generate alerts when significant price movements are predicted.

Start by tracking your own material spend over the past 18 months. Look for patterns—not just in total costs, but in the timing of spikes and dips. Were there seasonal trends? Did prices correlate with specific economic indicators you could monitor going forward? Most distributors can provide historical pricing data if you ask. Combine that internal information with external market intelligence, and you’ve got the foundation for smarter procurement decisions.

Building Buffer Strategies That Actually Work

Knowing a price increase is coming only helps if you can act on that information. Some contractors stockpile materials when forecasts predict upward trends, but this approach ties up cash and requires warehouse space. A more practical strategy involves tiered pricing in your quotes. Build in conditional clauses that adjust material costs if orders are delayed beyond a certain date, or offer discounts for clients who commit early and allow you to lock in current prices.

Another tactic is strengthening relationships with multiple suppliers. When you can compare forecasted price movements across different distributors, you gain negotiating leverage. If one vendor’s projections show a steeper increase than another’s, you have concrete data to discuss pricing holds or bulk discounts.

The Competitive Edge Nobody’s Talking About

Here’s what separates contractors who thrive from those who constantly scramble: they treat pricing intelligence as seriously as they treat craftsmanship. Predictive analytics gives you the ability to quote jobs confidently, maintain margins during volatile periods, and avoid the painful conversations where you’re asking clients for more money because materials cost more than you expected.

The roofing companies that adopt these tools now will spend the next few years wondering how they ever managed without them. The ones that wait will keep playing catch-up, adjusting their pricing after the damage is already done. Your choice is whether you want to lead the market or follow it.